Low Oil & Gas Prices Result in Major Asset Impairments Across the U.S.

Large impairments rocked many U.S. companies’ income statements at year-end 2014. The major cause of most of these impairments was the fall in global commodity prices in the final quarter of the year. This is the conclusion of a study looking into asset impairments using the annual data of 72 U.S. oil and gas companies (see notes 1 and 2) available in the Evaluate Energy database.

All data included in this article is available for download at this link

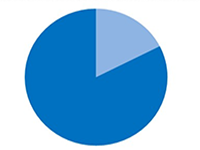

Impairment expenses occur in the oil and gas industry when the current carrying value of a company’s oil and gas properties, for any given technical or economic reason, can no longer be recovered under present conditions. Our data shows 49 of the 72 companies reported such impairment expenses in 2014, the total of which is around $45 billion. It is apparent that the global fall in commodity prices, while by no means being the only reason for 2014’s impairments, is the major cause for the widespread impairment expenses as a very large proportion of these $45 billion of impairment expenses occurred during Q4 and this is when the fall in prices began to take hold.